How Much the Average Australian Mortgage Costs

Understanding the ins and outs of mortgage costs in Australia is crucial whether you're stepping onto the property ladder for the first time or considering your next investment in real estate. The dream of owning a home down under is shared by many, but what does it actually cost to secure a mortgage in today's market?

In this blog post, we're shedding light on the average cost of a mortgage in Australia, and by the end, you'll have a clearer picture of what to expect and how to navigate your path forward.

Understanding Mortgages in Australia

First things first, let's demystify what a mortgage really is. At its core, a mortgage is a loan from a bank or financial institution that helps you purchase a property. The property itself serves as collateral for the loan, which means if for some reason you're unable to continue making payments, the lender may take possession of the property to recoup their funds.

In the Australian context, the housing market is as dynamic as it is diverse, with mortgage rates and property values fluctuating based on a myriad of factors including economic conditions, interest rates set by the Reserve Bank of Australia (RBA), and even global market trends.

Factors Influencing Mortgage Costs

Before diving into the numbers, it's essential to understand the variables that can affect the overall cost of your mortgage.

Interest Rates

Interest rates are arguably the most influential factor in determining your mortgage cost. These rates are influenced by the RBA's decisions, which are made in response to various economic indicators. A lower interest rate means lower monthly payments, making borrowing more attractive, while a higher rate does the opposite.

Loan Terms

The length of your loan, or its term, plays a significant role as well. Common terms in Australia range from 15 to 30 years, and the choice you make can significantly impact both your monthly payments and the total amount of interest you'll pay over the life of the loan.

Loan Amount

The size of the loan you take out, naturally, affects your mortgage cost. The more you borrow, the higher your monthly payments will be. This is where the down payment comes into play; the larger your down payment, the smaller your loan amount, and consequently, the less you'll spend on interest over time.

Type of Loan

Choosing between a fixed-rate or variable-rate mortgage can also impact your costs. Fixed-rate mortgages lock in your interest rate for a specific period, providing stability in your monthly payments. Variable-rate mortgages, on the other hand, fluctuate with the market, which means your payments could go up or down.

Average Mortgage Costs in Australia

With the basics covered, let's delve into the heart of the matter - the average mortgage costs in Australia. Keep in mind, these figures can vary widely depending on the factors we've discussed, but they'll give you a starting point for understanding what to expect.

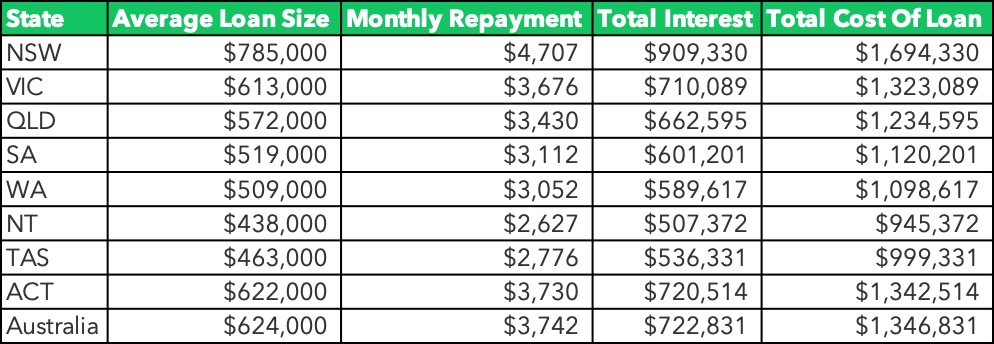

As of the latest data, the average mortgage size varies significantly across different states and territories. For instance, in a bustling city like Sydney, you might find average mortgage sizes to be higher than in more rural areas due to the higher property values. This geographical variance is important to consider as it directly influences your monthly repayments and overall loan cost.

To give you a more concrete example, let's assume an average mortgage size of $500,000 with a 30-year term at an interest rate of 3%. This scenario would result in monthly repayments of approximately $2,108. In contrast, if the interest rate were to increase to 4%, your monthly repayments would rise to about $2,387, highlighting the sensitivity of mortgage costs to interest rate changes.

Let’s consider the average mortgage costs based on the average balance across Australia at present, assuming an interest rate of 6%.

Monthly Repayment Examples

To further illustrate, let's consider a few more examples with varying loan amounts and interest rates:

Loan Amount: $400,000

Interest Rate: 3%

Term: 30 years

Monthly Repayment: ~$1,686

Loan Amount: $600,000

Interest Rate: 4.5%

Term: 30 years

Monthly Repayment: ~$3,040

These examples underscore the importance of understanding how different factors can affect your monthly outgoings and total loan cost.

Additional Costs to Consider

When calculating the cost of a mortgage, there's more to consider than just the loan amount and interest rate. Several other fees and charges can add up, impacting the overall cost of buying a home.

Home Loan Fees

Home loan fees can include application fees, loan establishment fees, ongoing account management fees, and more. Some lenders might charge you a fee for extra repayments or for paying off your loan early, especially in the case of fixed-rate loans. These fees can vary significantly between lenders, so it's important to ask for a comprehensive list of all potential charges before deciding on a mortgage provider.

Government Charges

Government charges can take a substantial bite out of your budget when purchasing a property. The most well-known of these is stamp duty, which is a tax levied on property purchases. The amount of stamp duty you'll owe depends on the state or territory in which you're buying the property, as well as the purchase price. In addition to stamp duty, you may also be responsible for land transfer registration fees and other statutory charges. Don't forget that for First Homebuyers there are often many incentives to avoid or at least reduce the stamp duty payable and purchase costs.

Other Expenses

Don't forget to factor in the ongoing costs of homeownership, which include home and contents insurance, property taxes (council rates), and regular maintenance. If your down payment is less than 20% of the purchase price, you may also need to pay for Lenders Mortgage Insurance (LMI), which protects the lender in case you default on your loan. All these costs can add up and should be considered as part of the overall expense of owning a home.

How to Manage Your Mortgage Costs

With the potential costs in mind, let's explore some strategies to manage your mortgage expenses effectively.

Finding the Best Mortgage Deals

Shopping around and comparing offers from different lenders can help you find the best mortgage deal. Don't just look at the interest rates; consider the fees, loan features, and flexibility. Mortgage brokers can be a valuable resource, as they have access to a wide range of products and can help you navigate the complexities of loan offers.

Reducing Mortgage Costs

One way to reduce the total cost of your mortgage is by making additional payments. Even small extra payments can significantly reduce the interest you pay over the life of the loan. If your circumstances change and you find yourself in a better financial position, consider refinancing your mortgage to take advantage of lower interest rates or better loan terms. However, be mindful of any fees or charges that might apply if you decide to refinance.

Loan Structuring

Choosing the right loan structure can also help manage your mortgage costs. For example, an offset account can reduce the interest payable by offsetting the amount in the account against your loan balance. Similarly, a redraw facility allows you to make extra payments on your loan and redraw them if needed, giving you flexibility while still reducing your interest payments.

Conclusion

As we've explored, understanding the average mortgage cost in Australia requires consideration of a range of factors, including interest rates, loan terms, and additional costs associated with purchasing a property. By arming yourself with knowledge and carefully planning your approach to securing a mortgage, you can navigate the Australian property market with confidence.

Remember, while the journey to homeownership can seem daunting, it's also an exciting step towards securing your future. With the right preparation and guidance, you can make informed decisions that align with your financial goals and lifestyle aspirations.

Ally Home Loans Pty Ltd is your ally in finance for all of your home loan, investment property, business and commercial financing needs. With our wide range of lending solutions, expertise in financial planning and investment strategies, and extensive experience in working with both Australian residents and Australian expats, we are your partners for your lending needs.

Book an obligation-free, complimentary consultation here today.

Ally Home Loans Pty Ltd is an Authorised Credit Representative (Credit Representative Number – 494608) of My Local Broker (Australian Credit License – 481374). Important Disclaimer: Your complete financial situation will need to be assessed before acceptance of any proposal or product.

Like this article? Share it with your network with the links below.