Interest Rates in 2024 - Ally Home Loans - Australian Mortgage Brokers

Where will interest rates go in 2024? Will mortgage holders be granted some reprieve with rate cuts from the RBA this year? The role of interest rates in shaping the economy cannot be overstated, affecting everything from personal savings to business investments.

In this blog, we delve into the complexities of predicting interest rates for the coming year, using the latest data and expert insights to guide us through this topic that is so important to Australian mortgage holders across the globe. Whether you’re a property investor, homeowner, or both, knowing where interest rates will end the year in 2024 is a valuable insight.

Economic Overview

In 2023, the Australian economy showcased moderate growth amid global uncertainties. The latest data from the Australian Bureau of Statistics (ABS) indicates a growth of 0.2% in the September quarter of 2023. This growth, primarily fuelled by government spending and investments in public infrastructure, reflects the government's efforts to sustain the economy in a period of global instability.

Diving deeper, the composition of the Australian economy provides more context. According to the Reserve Bank of Australia (RBA), key sectors like mining, finance, and health contributed significantly to the national output, with mining leading at 14.3%. The diverse contributions from these sectors highlight the multifaceted nature of the Australian economy.

On a state level, different regions have shown varying degrees of economic activity. New South Wales, for instance, accounted for 30.3% of the output, underscoring its role as an economic powerhouse. Such regional variations play a crucial role in shaping the overall economic environment and, by extension, the interest rate decisions.

Historical Perspective

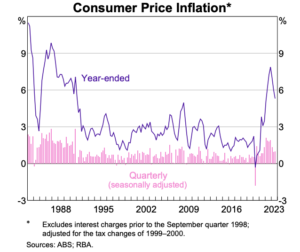

Historically, Australia's interest rates have witnessed fluctuations reflecting global and local economic conditions. A retrospective view reveals a pattern where interest rates often respond to broader economic indicators such as inflation, GDP growth, and unemployment rates.

For instance, during periods of high inflation, the RBA has traditionally raised interest rates to curb spending and control price rises. Conversely, in times of economic downturns, lower interest rates were used to encourage borrowing and stimulate the economy.

This pattern emphasises the importance of understanding historical trends. They not only provide a context for current economic scenarios but also help in anticipating future moves by the Reserve Bank of Australia (RBA) and other financial institutions.

In the following charts, we can see both the historical inflation and interest rates in Australia over the last ~40 years.

Key Factors Influencing 2024 Predictions

The prediction for 2024’s interest rates hinges on several key factors. First and foremost is inflation. As of late 2023, the RBA has indicated a possibility of further rate hikes if inflation remains high. This statement contrasts with market predictions, which lean towards expecting rate cuts in 2024, as reported by the Australian Financial Review.

Another significant factor is the global economic climate. Australia's economy, being highly integrated with global markets, is susceptible to international trends and events. Developments in major economies like the US and China can have ripple effects on Australia's economic policies and interest rates.

Domestic factors also play a crucial role. The housing market, consumer spending, and wage growth are all closely monitored by the RBA when making interest rate decisions. Any significant changes in these areas could lead to a shift in the monetary policy stance.

Expert Opinions and Analysis

Economic analysts are divided in their predictions for Australia's interest rates in 2024, reflecting the complex interplay of domestic and global economic factors. One school of thought, represented by analysts like Capital Economics' Abhijit Surya, leans towards a scenario where a sharper-than-expected fall in inflation could prompt the Reserve Bank of Australia (RBA) to initiate rate cuts as early as May 2024. This prediction is based on the assumption that the RBA will prioritise stimulating a slowing economy over its inflation targets.

Conversely, other experts, including ANZ's head of Australian economics Adam Boyton, suggest a more conservative approach from the RBA. They argue that the central bank might delay any rate cuts until late 2024, closely monitoring the inflation trajectory and its broader economic impacts. This perspective is rooted in the understanding that the RBA aims to balance inflation control with sustainable economic growth, a delicate act in an uncertain global economic environment.

The key determinant in this debate will likely be the December quarter inflation figures, scheduled for release at the end of January 2024. These figures will provide critical insights into the inflationary trends within the Australian economy, influencing the RBA's policy direction. The central bank's decision will hinge on whether inflation is trending towards their target band, with a focus on ensuring economic stability and growth.

Potential Scenarios for 2024

For 2024, several potential scenarios for interest rates are emerging based on the current economic data and expert analysis. In the best-case scenario, we could witness a gradual reduction in interest rates, following a significant decrease in inflation. This scenario would likely bolster consumer spending and invigorate business investment, contributing to overall economic growth. Such a trend would be indicative of a successful balancing act by the RBA, where inflation is controlled without hampering economic expansion.

In a less optimistic scenario, if inflation remains persistently high, the RBA might maintain or even increase interest rates. This approach, while aimed at curbing inflation, could have the side effect of dampening consumer spending and business investments, potentially slowing down the economy. This situation would require careful monitoring and adjustments from the RBA to prevent any long-term negative impacts on economic growth.

Another possibility is a mixed scenario where the RBA adopts a wait-and-see approach, making incremental adjustments based on emerging economic data. This strategy would involve a fine-tuning of interest rates, responding agilely to shifts in inflation, unemployment rates, and global economic pressures. Such a nuanced approach would reflect the RBA's commitment to navigating the complexities of the current economic landscape.

Government and RBA Policies

The Reserve Bank of Australia's (RBA) monetary policy decisions in 2024 will be pivotal in shaping Australia's economic trajectory. The RBA's primary focus remains on controlling inflation while ensuring that these measures do not adversely impact economic growth and employment. This balancing act is crucial as the RBA navigates through a landscape marked by global uncertainties and domestic economic challenges.

In addition to interest rate decisions, the RBA's approach to bond purchasing and portfolio management will significantly influence the financial markets and broader economy. The decision whether to continue holding bonds to maturity or to start selling off parts of its portfolio will be determined by several factors, including the bank's exposure to interest rate risks and the overall health of the economy.

Furthermore, government fiscal policies will also play a crucial role in conjunction with the RBA's monetary policies. Government spending, tax policies, and investment in infrastructure and social programs will interact with the RBA's monetary policies to shape the economic outlook for 2024. This interplay between fiscal and monetary policy is essential for ensuring a stable and growing economy, particularly in a period marked by global economic uncertainties and domestic challenges.

Conclusion

As we prepare for 2024, it's clear that the path for Australia's interest rates is paved with uncertainties and influenced by a multitude of factors. From global economic conditions to domestic market dynamics, each element contributes to the complex decision-making process of the RBA.

Stay tuned as we further explore the implications of these factors and provide practical advice for individuals and businesses navigating this ever-changing economic landscape.

Ally Home Loans Pty Ltd is your ally in finance for all of your home loan, investment property, business and commercial financing needs. With our wide range of lending solutions, expertise in financial planning and investment strategies, and extensive experience in working with both Australian residents and Australian expats, we are your partners for your lending needs.

Book an obligation-free, complimentary consultation here today.

Ally Home Loans Pty Ltd is an Authorised Credit Representative (Credit Representative Number – 494608) of My Local Broker (Australian Credit License – 481374). Important Disclaimer: Your complete financial situation will need to be assessed before acceptance of any proposal or product.

Like this article? Share it with your network with the links below.